Liquid Mining Tokens & Locked Mining Rewards

How Qai Network enhances mining incentives and network security through innovative reward mechanisms.

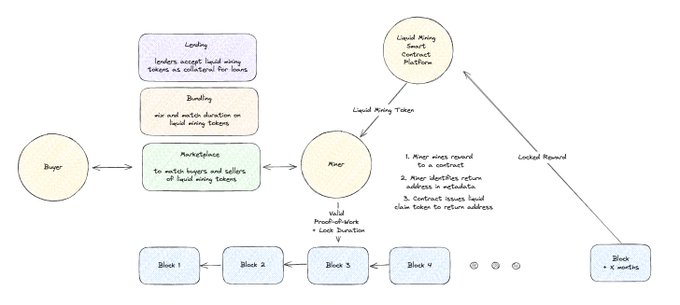

Two Innovations for Mining Economics

Qai introduces two complementary systems that revolutionize mining economics: Locked Mining Rewards (LMR) and Liquid Mining Tokens (LMT). Together, they solve a fundamental challenge in GPU mining networks - creating long-term miner commitment similar to ASIC networks while maintaining capital flexibility.The GPU Mining Challenge: GPU miners can easily switch between networks, creating security vulnerabilities. Unlike ASIC miners who invest in network-specific hardware, GPU miners have no long-term capital commitment. This makes GPU networks more vulnerable to attacks from rental hashrate or opportunistic miners. Qai’s Dual Solution:

Locked Mining Rewards (LMR): Incentivizes long-term commitment through enhanced yields

Liquid Mining Tokens (LMT): Provides liquidity for miners who need immediate capital

This combination creates ASIC-like security commitment in a GPU-friendly network.

Locked Mining Rewards (LMR): Building Long-Term Security

Locked Mining Rewards allow miners to voluntarily lock their block rewards (coinbase) for extended periods in exchange for significantly higher yields. This creates the economic commitment that GPU networks traditionally lack.How LMR Works: When a miner successfully mines a block, they can choose to:

Standard maturity: Receive rewards after 2 weeks (no bonus)

3-month lock: Earn enhanced rewards with longer commitment

6-month lock: Earn even higher rewards for extended commitment

12-month lock: Maximize rewards with up to 25% APY for full-year commitment

Security Benefits: LMR creates ASIC-like network security without specialized hardware:

Capital commitment: Miners have real economic stake in network’s future

Attack resistance: Locked rewards make hit-and-run attacks unprofitable

Hashrate stability: Long-term commitments reduce mining volatility

Aligned incentives: Miners benefit from network growth over lock period

The longer lock periods and higher rewards create a powerful incentive for miners to commit to Qai’s long-term success, dramatically improving network security compared to traditional GPU mining.

Liquid Mining Tokens (LMT): Maintaining Capital Efficiency

While LMR creates security through commitment, many miners can’t afford to lock capital for months. Liquid Mining Tokens solve this by creating a secondary market for locked rewards.How LMT Works:

Miner locks rewards: Chooses LMR for higher yields

Receives LMT tokens: Wrapped version of their locked rewards

Can trade immediately: Sell LMTs on markets for immediate liquidity

Market pricing: LMTs trade based on time to maturity and yield

Capital Benefits:

Immediate liquidity: Miners can access capital without waiting

Competitive pricing: Market forces ensure fair value discovery

Operational flexibility: Pay bills while earning enhanced yields

Risk management: Option to hold or sell based on market conditions

This system allows miners with different capital positions to participate optimally - well-capitalized miners can hold for full yields, while others can trade LMTs for immediate cash flow.

LMR Reward Schedule: Incentivizing Commitment

The reward multipliers are carefully designed to balance miner incentives with network sustainability. Early miners receive the highest bonuses, encouraging early adoption and long-term commitment when the network needs it most.

2 weeks*

1.000000x

1.000000x

1.000000x

1.000000x

1.000000x

3 months

1.035000x

1.017500x

1.008750x

1.004375x

1.002188x

6 months

1.100000x

1.050000x

1.025000x

1.012500x

1.006250x

12 months

1.250000x

1.125000x

1.062500x

1.031250x

1.015625x

*Standard 2-week maturity period with no lock bonusKey Insights:

Year 1 advantage: Up to 25% APY rewards early network supporters

Gradual reduction: Multipliers decrease as network matures

Long-term sustainability: Ensures viable economics throughout network lifecycle

Clear incentives: Longer locks always yield higher rewards

This structure creates powerful early incentives while ensuring the network remains economically sustainable as it grows.

DeFi Integration: Creating a Mining Finance Ecosystem

The LMT system opens up entirely new DeFi possibilities. Since LMTs are standardized tokens representing future mining yields with specific maturity dates, they become building blocks for sophisticated financial products.Potential DeFi Applications:1. LMT Trading Markets:

Spot markets: Direct buying/selling of LMTs

Time-based pricing: Different prices for different maturities

Arbitrage opportunities: Between lock durations and yields

Price discovery: Market determines fair value of future rewards

2. Lending & Borrowing:

Collateralized loans: Use LMTs as collateral for immediate liquidity

Yield optimization: Borrow against LMTs at rates lower than lock bonus

Risk management: Hedge mining operation costs

3. Structured Products:

LMT bundles: Diversified portfolios of different maturities

Yield ladders: Staggered maturity dates for consistent cash flow

Mining funds: Professional management of LMT portfolios

The Bigger Picture: This creates a complete mining finance ecosystem where:

Small miners can access capital markets efficiently

Large operations can optimize their treasury management

DeFi protocols gain access to real yield from mining

The entire network benefits from improved capital allocation

The LMR/LMT system transforms mining from a simple block reward system into a sophisticated financial ecosystem that benefits all participants.

Last updated