Faster Finality

How transactions achieve finality in Quai Network.

What is Finality?

When you send a transaction, how long do you have to wait before you’re confident it can’t be reversed? This waiting time is called finality.Two Types of Finality:

Statistical Finality: Mathematical certainty your transaction is permanent (barring a 51% attack)

Economic Finality: The cost to reverse your transaction exceeds any attacker’s benefit

Why Faster Finality Matters:

Better user experience: No waiting 10+ minutes for Bitcoin confirmations

Enables commerce: Merchants can accept payments instantly

Reduces uncertainty: Clear when transactions are truly final

The Challenge: Quai’s Multi-Chain Architecture

Quai Network uses a hierarchy of blockchains:

Prime chains: Main coordination chains (slower, more secure)

Region chains: Regional coordination chains

Zone chains: Individual transaction chains (faster, where users interact)

The Problem: In traditional systems, transactions on fast chains (zones) aren’t final until confirmed by slow chains (prime). This creates uncertainty.

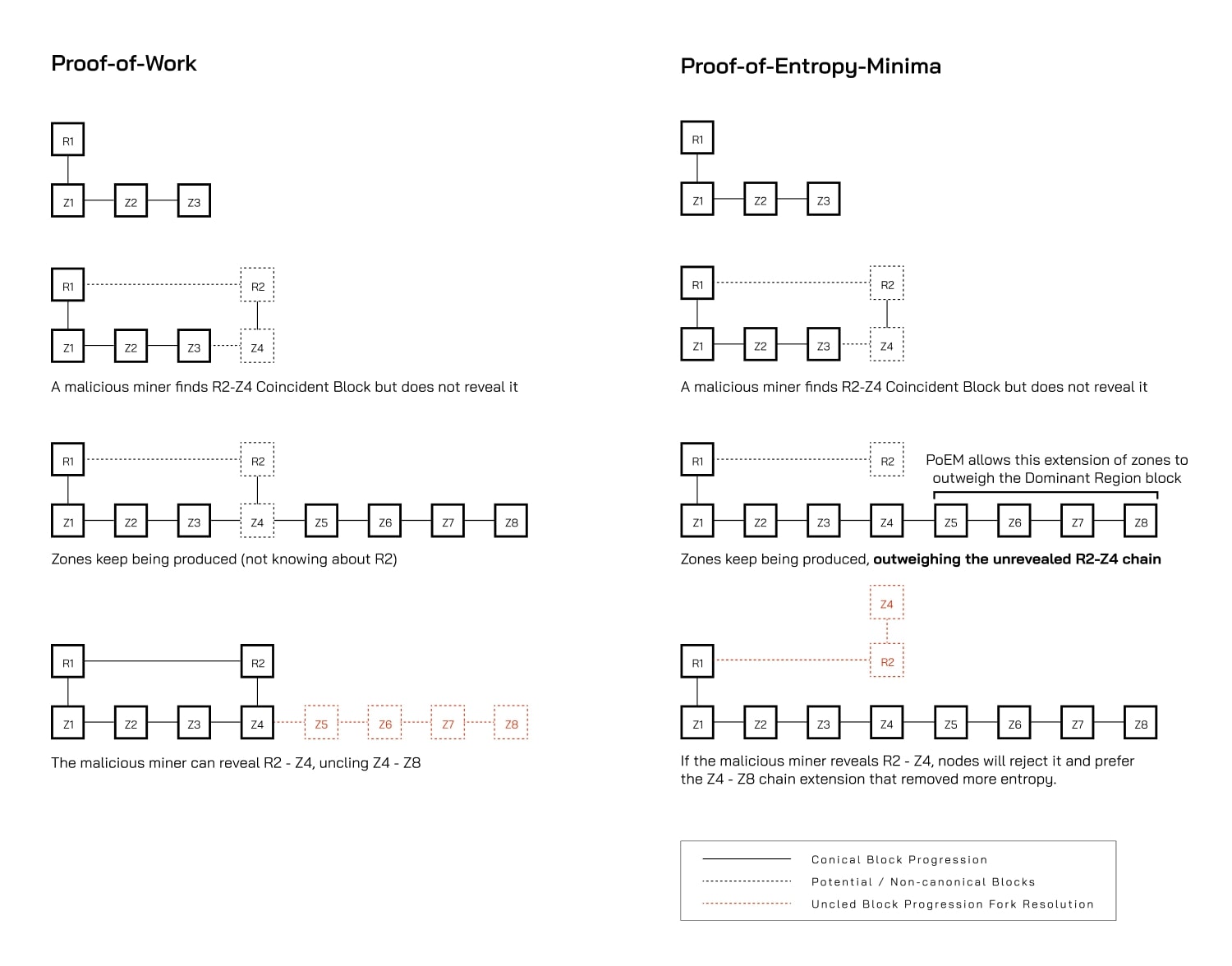

The Withholding Attack Problem

What’s a Withholding Attack? Imagine a miner finds a valid block but doesn’t immediately broadcast it. Instead, they hold it back while other miners waste energy mining the previous block.In Single Chains (like Bitcoin):

Attacker holds back a block for ~10 minutes

Minimal impact since no transactions process between blocks

Eventually another miner finds a block, making the withheld block worthless

In Multi-Chain Systems (Traditional Approach):

Zone chains process transactions continuously

But those transactions aren’t final until prime chain confirms

Attacker could hold back a prime block, keeping zone transactions uncertain

Much more disruptive than single-chain attacks

PoEM’s Solution: Bottom-Up Finality

Traditional Hierarchy (Top-Down):

Prime chains lead, zone chains follow

Zone transactions wait for prime confirmation

Vulnerable to prime chain withholding attacks

PoEM Hierarchy (Bottom-Up):

Zone chains can achieve finality independently

Prime chains follow zone chain entropy accumulation

Withholding attacks become ineffective

How This Works:

Zone chains remove entropy faster than prime chains (due to higher frequency)

Even the “luckiest” possible prime block can’t outweigh zone chain accumulation for long

Transactions achieve finality in seconds, not minutes

Finality Comparison

Bitcoin

10+ minutes (1 block)

Wait for longest chain

Ethereum

12+ minutes (2 epochs)

Wait for 2/3 validator approval

Quai PoEM

~5 seconds (1 zone block)

Entropy accumulation measurement

Why PoEM is Faster:

Objective measurement: Entropy is mathematically scarce, not subjective

Independent chains: Zone finality doesn’t depend on prime blocks

Precise calculation: Measures exact work, not arbitrary thresholds

Learn more about the mathematical details of this calculation.

Economic Finality: Real-World Security

What is Economic Finality? The point where reversing your transaction would cost an attacker more than they could possibly gain.Real-World Examples:

Coffee purchase ($5): Economically final almost instantly

Car purchase ($50,000): May need 30+ minutes for full economic security

House purchase ($500,000): Could require hours of confirmations

Factors Affecting Economic Finality:

Transaction value: Higher value = longer wait time needed

Network hashrate: More miners = better security = faster finality

Pending transactions: Network congestion affects attack costs

Market conditions: Token price volatility impacts attack economics

Built-in Economic Finality Tool

Quai Network includes a smart finality calculator that:Analyzes Network Conditions:

Current hashrate and mining distribution

Pending transaction volumes and fees

Historical attack costs and patterns

Provides Custom Recommendations:

Instant decisions for small transactions

Precise wait times for large transfers

Real-time updates as conditions change

Use Cases:

Merchants: Know exactly when payments are safe

Exchanges: Minimize deposit wait times while maintaining security

Users: Understand the security level of their transactions

Last updated